In regards to taking care of hazard, All people desires a security Internet. Insurance coverage solutions are accurately that—a way to protect oneself from unanticipated functions that would toss a wrench into your life. Whether or not It is vehicle insurance, property insurance coverage, or overall health coverage, an insurance policy solution provides satisfaction, recognizing that if points go Improper, you do have a backup system. But how can you select the best coverage solution? With lots of solutions available, It is simple to experience overwhelmed. Let us crack it down and discover the planet of insurance, 1 move at any given time.

Some Known Incorrect Statements About Insurance Solution

Exactly what is an insurance policy solution? At its Main, an insurance coverage Remedy is solely a method to scale back fiscal threat by transferring the cost of specific events, like accidents, harm, or disease, to an insurance policy provider. This enables persons or enterprises to manage the doubtless catastrophic costs that might arise from the event of the crisis. But picking out the correct one isn't straightforward. Factors like coverage sorts, plan conditions, and your own or enterprise requires play a large part in deciding what the most effective Answer for you might be.

Exactly what is an insurance policy solution? At its Main, an insurance coverage Remedy is solely a method to scale back fiscal threat by transferring the cost of specific events, like accidents, harm, or disease, to an insurance policy provider. This enables persons or enterprises to manage the doubtless catastrophic costs that might arise from the event of the crisis. But picking out the correct one isn't straightforward. Factors like coverage sorts, plan conditions, and your own or enterprise requires play a large part in deciding what the most effective Answer for you might be.Insurance plan methods can be found in many kinds, Each individual intended to cover a certain form of risk. For instance, car insurance protects you in case of a car or truck incident, though health and fitness insurance plan features coverage for health care expenditures. Homeowners insurance policy guards your property from destruction, and existence insurance policies helps your family and friends economically if you're no more all-around. These alternatives may appear straightforward, but In point of fact, Just about every sort requires different alternatives and riders which can complicate your selection-producing method.

Deciding on an insurance coverage Alternative isn’t just about buying The most cost effective solution readily available. Positive, Expense is important, but what’s Similarly critical is comprehending the value with the coverage you’re having. Are you currently paying for protection you don’t have to have? Are you currently underinsured, this means the coverage won’t give more than enough security when disaster strikes? It’s simple to overlook these concerns any time you’re confronted with a sea of choices, but finding the time to check with them could help you save from generating high priced mistakes down the road.

Considered one of The key factors to take into consideration when deciding upon an insurance plan Answer would be the insurance provider’s popularity. Not all insurance policy vendors are established equal. Even though lots of providers provide comparable protection, the caliber of services, simplicity of statements approach, and fiscal balance could vary appreciably. A very good insurance plan company must be very easy to talk to and responsive after you require them quite possibly the most. If a claim is denied or the method normally takes far too lengthy, it defeats the objective of acquiring insurance coverage in the first place.

Talking of claims, the claims process is an essential Section of any insurance Answer. A coverage could seem great on paper, but when it will come time for you to file a assert, you’ll immediately realize how significant it really is to select the proper provider. How speedily does the insurance provider system promises? Do they supply on-line or mobile phone help? Are there concealed costs or difficult paperwork included? They're all inquiries you need to question just before committing to any insurance Option.

A different critical aspect in finding the correct coverage Alternative is knowing the various forms of coverage. By way of example, with car insurance coverage, there’s legal responsibility coverage, collision coverage, and detailed coverage. Each of these serves a distinct objective and handles distinct threats. Knowing the nuances concerning these choices is important to ensuring that you just’re absolutely secured. The same applies to other kinds of insurance policy, like wellness coverage, where by you may have alternatives in between HMO, PPO, and other types of options, Each individual with different levels of coverage and adaptability.

You could question: Why are there numerous options? Effectively, the reality is, Absolutely everyone’s desires are unique. The best insurance policies solution for one particular person may not work in the slightest degree for some other person. This is where personalization comes into Perform. Your exceptional condition—your health and fitness, the value of your property, your driving patterns, and also your age—can influence which kind of protection you may need. It’s about getting a solution that fits your daily life and features the ideal standard of safety without overloading you with unneeded attributes.

Enable’s acquire wellbeing insurance policies for example. To get a younger, healthier one that almost never requirements clinical treatment, a large-deductible well being program could possibly be an excellent insurance coverage Answer, as it keeps rates very low. But for someone using a Serious disease or even a household to care for, a far more comprehensive system with reduce deductibles and broader protection could make additional sense. The important thing is to find a harmony concerning what you require and Everything you can afford to pay for.

The Basic Principles Of Insurance Solution

Insurance coverage remedies also are becoming additional adaptable, Specially with the rise of electronic resources and on the web platforms. Previously, paying for insurance solution coverage was frequently a laborous procedure that included paperwork, experience-to-deal with meetings, and extensive cellular phone calls. Now, a lot of insurers offer streamlined digital remedies that permit you to Evaluate insurance policies, get offers, and buy protection all from a cell phone or Pc. This has manufactured the process much easier, a lot quicker, and a lot more available for those who don’t want to spend several hours navigating intricate insurance coverage lingo.But just like all points, technological know-how has its downsides. With the convenience of on-line platforms arrives the possible for information overload. There’s a lot of data out there given that it can be not easy to sift by means of all of it and make an informed selection. That’s why it’s important to do your investigate and, if necessary, check with having an insurance agent who can tutorial you through the method and allow you to fully grasp the nuances of each and every choice.

Now, let’s talk about the price of an insurance Alternative. Anyone wants to find the greatest protection at the best cost, but occasionally it can really feel such as you’re hoping to find a needle inside of a haystack. How do you equilibrium affordability with sufficient safety? One strategy is to buy around and compare quotes from multiple insurers. Numerous Web-sites help you Assess distinctive designs as well as their insurance solution affiliated costs, rendering it much easier to discover an answer that works for your budget. But don’t just think about the quality—think about the deductible, coverage restrictions, and any exclusions that can leave you uncovered.

Yet another way to keep insurance policy expenses workable is by bundling your guidelines. One example is, lots of insurers offer you bargains if you buy numerous types of protection, like property and auto insurance coverage, from your very same firm. Bundling might be a successful way to lessen your All round high quality without sacrificing coverage. It’s just a View more little like obtaining in bulk at a keep—buying a number of products and solutions with the exact organization often leads to cost savings.

Even though we’re on the topic of prices, it’s imperative that you do not forget that The most affordable solution may not usually be the most beneficial insurance policies solution. In reality, going for the lowest value could end up costing you extra Ultimately in case you end up getting insufficient protection. When selecting an insurance coverage Remedy, target the overall value of the coverage, not just the price tag. A slightly bigger quality may possibly offer far more complete protection, rendering it a much better expense for your long run.

Insurance plan answers also can help organizations remain afloat in times of crisis. For enterprises, the right insurance coverage coverage can mean the difference between surviving a catastrophe and closing store. Professional insurance plan methods address a wide range of dangers, like assets destruction, liability, personnel injuries, and more. For business people and business people, being familiar with the precise threats that might affect their operations is essential to obtaining an insurance policy solution that keeps them safe. Small business insurance policy is a bit more sophisticated than own protection, however it’s just as essential to ensure money balance in the deal with of unpredicted challenges.

Have you at any time thought about everyday living insurance policies? Many individuals consider daily life insurance policy to be a morbid necessity, a thing they only need to consider if they’re Significantly more mature. But in reality, life insurance policy may be A necessary Section of a fiscal strategy for persons of any age. Lifestyle insurance plan makes sure that your loved ones gained’t be economically burdened if anything comes about to you. It’s a means of shielding your family’s long term and supplying them the sources to help keep relocating forward, no matter what.

The smart Trick of Insurance Solution That Nobody is Discussing

Another thing to keep in mind when picking out an insurance plan Answer is the fact guidelines can modify as time passes. As your life conditions evolve, so need to your coverage. For example, if you get a house, it’s time and energy to investigate homeowners coverage. When You begin a loved ones, you might have to update your daily life insurance policies coverage or add additional overall health protection. And when you get older, your well being insurance policy wants may possibly change, necessitating a different coverage Option. Constantly reassess your protection periodically to make sure that it aligns with the current daily life scenario.

So, no matter whether you’re insuring your vehicle, your health and fitness, or your small business, the proper insurance policies Resolution can give the safety you need to face the future with self-assurance. Insurance may not be the most enjoyable topic, however it’s one among The most crucial choices you’ll at any time make. After all, most of us experience risks every day—whether it’s driving, having Unwell, or working with the unpredicted. The proper coverage solution is your security Internet, making certain that if the worst takes place, you’re coated.

In summary, insurance plan remedies are essential tools for managing chance and safeguarding your monetary future. From auto and residential coverage to everyday living and well being coverage, there’s an answer For each and every require. The main element to discovering the proper Option is knowing your very own desires, doing your investigate, and choosing an insurance provider with a good reputation. Insurance policy is focused on peace of mind, and with the proper coverage, you are able to rest straightforward recognizing that you’ve taken techniques to protect oneself and your loved ones.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Lacey Chabert Then & Now!

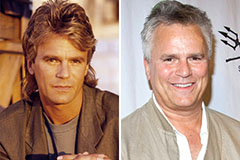

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!